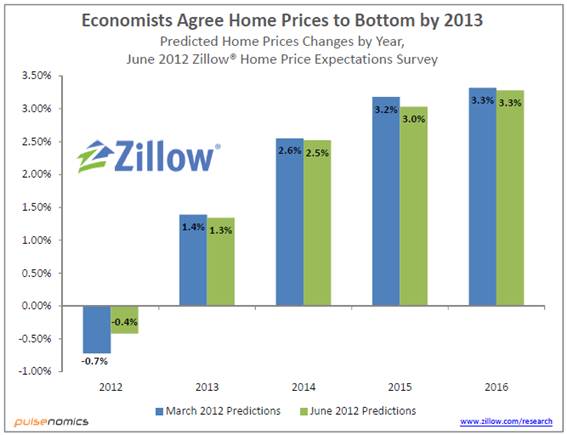

Every Month or so my good friends over at KCM take a snap shot survey of home prices and their future predictions. Today they released their findings from 5 national home price indexes. The good news? It’s unanimous belief that home prices will increase in 2013 vs. 2012. The amount? A modest 2.4%.

See this link for the full story: Where Are House Prices Headed?.