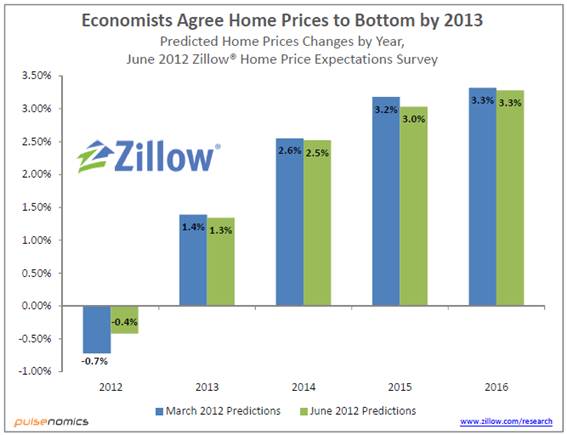

Inman new recently released a survey conducted by Pulsenomics LLC on behalf of Zillow showing expected home pricing growth. This group of 114 participants expect to see a growth or increase in the average home value for U.S. single family homes. We’ll see if this comes to fruition or not.

For the full story – check out the original post by Inman News here: Economists expect 2013 home price rebound | Inman News.